Black Tuesday: Why the Stock Market Crash of 1929 Was So Terrible

We’ve had our share of market slips, but none that shook the nation so severely.

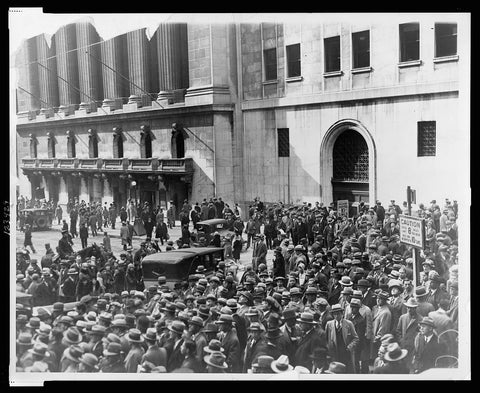

By percentage, Oct. 29, 1929, now known better as Black Tuesday, was only the fourth- biggest Dow Jones drop in U.S. history, as the markets tumbled 11.73%. Unfortunately, it came the day after the third biggest fall, with its 12.82% slip. For bonus trauma, the market — which had soared all the way to 381 that September and seemed bound to break 400 — now drifted under 200. A barrier had indeed been shattered, just not in the expected direction.

There had been hope Black Monday would prove to be another Black Thursday. (Which had happened just the previous week.) On that occasion, the markets plummeted, but major banks and investment companies bought up huge chunks of blue chip stocks, fighting off the panic and minimizing the day’s losses.

After Black Tuesday, it was clear there would be no rescue. Uncertainty added to the stress as, in the days of ticker tape trading, the massive number of trades meant it took hours before brokers could even discover a stock’s price, forcing them to endure an agonizing wait to learn just how much they’d lost.

GET HISTORY 'S GREATEST TALES—RIGHT IN YOUR INBOX

Subscribe to our Historynet Now! newsletter for the best of the past, delivered every Wednesday.

Close

Thank you for subscribing!

Submit

Jumping From Windows ****

Reports of suicides spread, to the point it seemed that to walk down Wall Street was to risk being crushed by a stockbroker plummeting from his window.

Reporters and historians have since confirmed there were not mass suicides. (Incredibly, it appears Winston Churchill — yes, that Winston Churchill — played a major role in the spread of this rumor. He had indeed witnessed someone fall from a window during a stay in New York City on Oct, 24, 1929, aka Black Thursday, but the man was a German chemist on a sightseeing visit who accidentally fell to his death—even if it was a suicide, something else must have triggered it as he died hours before the market dipped.)

But Black Tuesday unquestionably signaled a dark new era, as the United States plunged into a Great Depression.

This is why Oct, 29, 1929 is a date like Dec. 7, 1941, or Sept. 11, 2001, one that not only signals the future will be different (and more difficult) than expected but forces us to look at earlier events in a new light.

' A Chicken for Every Pot'

In 1920, Warren G. Harding was elected to the presidency with 60.4% of the popular vote, the first time a Republican had won a presidential election since 1908.

World War I (the so-called “war that will end war,” according to H.G. Wells) had only ended in November of 1918. Harding offered what, for the time, proved an appealing vision for the nation: “America's present need is not heroics but healing; not nostrums but normalcy.”

In short: He promised peace, stability, even serenity.

And sure enough, America was happy. The Roaring Twenties saw the nation’s total wealth more than double. Harding’s death prevented him from being triumphantly reelected, but Vice President Calvin Coolidge won easily in 1924. In 1928, fellow Republican Herbert Hoover crushed Democrat Al Smith. Hoover supporters ran an ad promising “A Chicken for Every Pot” and it seemed entirely reasonable — after all, the economy continued to grow.

In particular, the stock market surged: That 381 in 1929 becomes all the more remarkable when you consider the market was at 63 in 1921. Indeed, stocks became seen as a sure thing. Not just a solid investment, but money in the bank. In fact, better than the bank — if you had money in the bank, instead of in the stock market, you were losing money!

Quite simply, people became desperate to invest in stock, even if they had to go into debt to do so. Buying on margin? Great! Mortgage your home? Why not — you’ll get it all back soon enough!

And why wouldn’t they? Wherever they looked, they could find reassurance this was a prudent decision. On Oct. 16, 1929, The New York Times quoted economist Irving Fisher proclaiming “stock prices have reached ‘what looks like a permanently high plateau.’”

And on Oct. 25, President Herbert Hoover himself declared, ”The fundamental business of the country, that is, production and distribution of commodities, is on a sound and prosperous basis.”

The Fall ****

Even before the crash, there were causes for concern. Hoover’s reassurance aside, production had declined and unemployment had increased. Yet wildly optimistic speculation continued, under the belief that things could only go up.

And then on Black Monday and again on Black Tuesday, they didn’t.

In the aftermath of the crash, the markets would rise occasionally, but they also continued to tumble. By 1932 stocks were worth 20% of their 1929 peak.

Of course, the damage went beyond markets. 1932 saw the unemployment rate hit 23.6%.

Was the stock market crash of 1929 inevitable? ****

Could the stock market crash have been prevented? How about the Great Depression itself?

These are complex questions, ones that historians and economists will likely be debating every time there is an economic downturn for the rest of American history.

What’s undeniable is this: They did happen. And they happened on Herbert Hoover’s watch. Which had major implications for both political parties.

A Rapid Realignment

With the benefit of hindsight, Hoover was a more impressive leader and human being in general than Harding or Coolidge. This isn’t saying much: Since his death, Harding has been linked to a huge number of scandals, ranging from the Teapot Dome bribery case to an array of affairs that led Politico to dub him “America’s Horniest President”; Coolidge was believed to have slept up to 15 hours a day, including a lengthy afternoon nap, and allegedly offered the keen economic analysis, “When a great many people are unable to find work, unemployment results.”

Hoover, on the other hand, was an orphan who graduated with Stanford’s first class (as the first to arrive on campus, he was technically their first student), went on to become a millionaire as a mining engineer, and did an undeniably brilliant job overseeing relief efforts during World War I.

But he was the wrong man for the Great Depression. At a time when the nation’s confidence was at all-time low, his announcing that “[e]conomic depression cannot be cured by legislative action or executive pronouncement” was hardly going to restore morale. __

Worse were Hoover’s efforts to simply downplay the crisis, such as when he asserted in March of 1930 that "all the evidences indicate that the worst effects of the crash upon unemployment will have passed during the next 60 days.”

They would not — indeed, soon “Hoovervilles” would dot the nation.

Hoover won in 1928 with 58.2% of the vote and 444 electoral votes. In 1932, Hoover plummeted to 39.6% and 59 as Democrat Franklin Delano Roosevelt swept into office and immediately launched his New Deal. A full recovery wouldn’t come until Pearl Harbor mobilized the entire economy for World War II.

And the stock market? It would return to its 1929 high … in 1954. Ironically, this happened during the administration of Dwight Eisenhower, as after four Roosevelt victories and another for Harry S. Truman, Ike became the first Republican to win the White House since Herbert Hoover. That happened all the way back in 1928, a time when anything less than complete prosperity seemed absurd.

historynet magazines

Our 9 best-selling history titles feature in-depth storytelling and iconic imagery to engage and inform on the people, the wars, and the events that shaped America and the world.